Making a difference: our Impact Report 2021

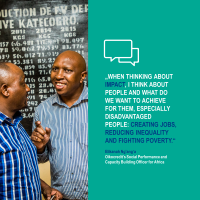

Elikanah Ng'ang'a, Oikocredit’s Social Performance and Capacity Building Officer for Africa

We interviewed Elikanah Ng'ang'a, Oikocredit’s Social Performance and Capacity Building Officer for Africa, to get behind the numbers in our latest Impact Report 2021. He provides us with insights into the many aspects of his work supporting our partners and the difference Oikocredit is making.

After working for microfinance organisations, Elikanah joined Oikocredit 12 years ago in the role of Social Performance and Capacity Building Officer. Initially focussed on East Africa, he now takes care of our partners throughout Africa.

Based in Nairobi, Elikanah is responsible for environmental, social and governance (ESG) partner assessments, identifying partners’ capacity building needs and preparing and monitoring capacity building projects. He also works with partners to raise capacity building funds and to report back to the donors.

Can you tell us why Oikocredit measures impact and publishes an impact report every year?

We want to be accountable to ourselves and our social mission, which is to improve the lives of low-income people by financing organisations in the Global South. If we don’t measure, we don’t know if we are living up to that mission. This helps us focus on areas of our social mission where we can make improvements.

By asking our partners to submit their impact data, we are also holding them to account. Our partners are attracted to Oikocredit because we are a social investor and by publishing a report, we attract new partners.

We also know from employee surveys that Oikocredit staff work for impact and that this motivates them. Being able to report on our mission attracts, motivates and helps to retain our Oikocredit people.

Last but not least, our impact is very important to our investors. They trust us with their money, and they care about the impact of their money. The impact report is important to them to understand what their investment is doing. The report is also crucial for attracting new investors.

What impact achievements do you think Oikocredit can be most proud of over the past year or so?

In two words, I would say our support for partners has been about survive and thrive.

When the pandemic came to Africa, we managed to organise ourselves quickly and give partners repayment holidays during the lockdown periods. This was to help our partners simply to survive. survive.

We also helped partners with grants from the Oikocredit solidarity fund to provide protective equipment, for example. This again was about survival. We brought leaders from our partners together in video conferencing to share ideas of how to survive. There were many Covid-19 initiatives to help our partners and for this we can be proud.

Now we see many organisations coming to us for help with their liquidity, as they get through the survival stage and now want to thrive. Our response has been to speed up our loan process to meet this urgent need, so they can in turn improve their response to their clients.

In recent surveys by the African Management Institute, nearly 80% of businesses have said that what makes the biggest difference to the impact of the pandemic is simply a loan to improve liquidity. Oikocredit is helping businesses back on the path to growing again.

How was Oikocredit’s impact affected by the pandemic?

The first thing to say is that we have not reached as many new partners and end clients as we had planned, and so you could say that our social impact has therefore been less than expected, as a result of the pandemic.

The pandemic meant adapting our plans, postponing planned growth of our development finance portfolio, reduced refinancing and suspending the disbursement of loans to new partner organisations. This enabled us to focus on supporting current partners through the crisis.

Our existing partners have also reduced their ambitions due to the pandemic, which further depresses the number of end-clients we have been able to reach. And for some end-borrowers who have savings, they have chosen to fall back on those funds and not take out new loans during these uncertain times.

Has the pandemic changed the way you think about creating a positive social impact?

In a way yes, because the pandemic has shown us the big cracks between the rich and poor, which is an ever-widening gap. For the most part, people of higher income levels seemed to have fared better than poor people in this pandemic. For example, in Africa, for some people with Covid-19 it is near impossible to get the healthcare they need. People have been dying because they can’t afford to pay for oxygen.

At Oikocredit we therefore have to double our efforts to reduce poverty in low-income countries and rural areas. We can’t do this alone and we need to find ways of working with others. In our new strategy that is currently being developed, I see great promise because we are trying to work with a wider range of organisations and develop ways of working together for even greater impact.

The pandemic has also shown that we are all connected. When a country is in lockdown, I can no longer visit partners and partners can no longer visit their clients. There are also limitations on a global level, which impacts on business between countries. The pandemic teaches us that there is no such thing as a faraway problem, and we must work together globally to solve the problems of poverty and inequality.

Do you think the pandemic has created greater needs in Africa?

Yes. If you look at Africa as a whole, 54 countries, less than 2% of the population has been fully vaccinated against Covid-19. So this pandemic will continue to impact Africa for a long time and we know that this will cause great suffering.

Africa already has a greater share of poverty, and inequality can only worsen for a continent already impacted by climate change, drought and famines. With its poor healthcare we will see a greater need for investment to alleviate some of this suffering.

Also in Africa, projects such as renewable energy will help because so many people are not connected to the electricity grid or have access to clean forms of energy.

What does Oikocredit’s impact mean to you personally?

I am hugely passionate about the work of Oikocredit. When thinking about impact, I think about people and what do we want to achieve for them, especially disadvantaged people: creating jobs, reducing inequality and fighting poverty.

And then I turn to the environment and the impact of climate change. When I look at onboarding new partners, I am thinking how are we to create positive impact on the environment?

Always, I think how we may support our partners’ financial sustainability. If we can contribute to their financial sustainability they will be there tomorrow to serve their end-clients and smallholder farmers.

I try to use the ESG score as a basis for developing support through our capacity building programmes. One thing especially close to my heart, is the creation of jobs by supporting small and medium enterprises. Because I believe that if you offer people decent jobs, you offer a way out of poverty, especially for young people.

How do you personally contribute to a global positive impact in your daily practice?

That’s an important question. I’m an accredited by Cerise as a Client Protection Principles assessor and social performance auditor, and I also contribute to global initiatives on social performance improvement.

Recently I enrolled in a course and expect by the end of the year to be accredited as an environmental impact assessment and Environmental impact Auditor.

There are other things I like to do, like being a board member of a school in Kibera and I’m involved in a neighbourhood project to create locally generated solar water heating.

I was born in a rural area and I have returned there recently to plant trees and encourage neighbours to do the same, with small forests now being developed here and there.

Like the many different aspects of my work for Oikocredit, these are small steps I take that make a big difference in impact.

Archive > 2021 > September

- 23/09 - Change to Oikocredit’s Managing Board

- 22/09 - Supporting partners’ innovative responses to Covid-19

- 22/09 - Oikocredit is partnering with Sidian Bank to support SMEs in Kenya

- 20/09 - Making a difference: our Impact Report 2021

- 15/09 - Impact Report 2021 is live!

- 03/09 - Carlos and Esteban’s story: Securing a better future